Best savings accounts 2020 all rates and options compared The Scottish Sun

High-Yield Savings Accounts Luring Spenders. Should You Move Your Cash? High-yield savings accounts are offering rates as high as 5.33%, drawing 3 in 5 Americans to save rather than spend,.

Best Savings Accounts (UPDATED 21/04/2023) Easy Money Saving

A "restricted account" is a savings account where a family who is getting cash aid can keep money to be spent for certain purposes. The savings account can be in any financial institution, such as a bank, credit union, savings and loan, etc. You can have more than one restricted account. Takedown request | View complete answer on cdss.ca.gov.

What are the 3 Main Types of Savings Accounts in Canada? TFSA, HISA, & Joint

How do I make an untouchable savings account? Here are seven ways you can stop dipping into your savings account each month, and start building savings instead. Set Up an Emergency Fund.. Switch to Cash-Only.. Move Your Savings to Another Bank.. Find Additional Income.. Find Ways to Cut Your Other Expenses..

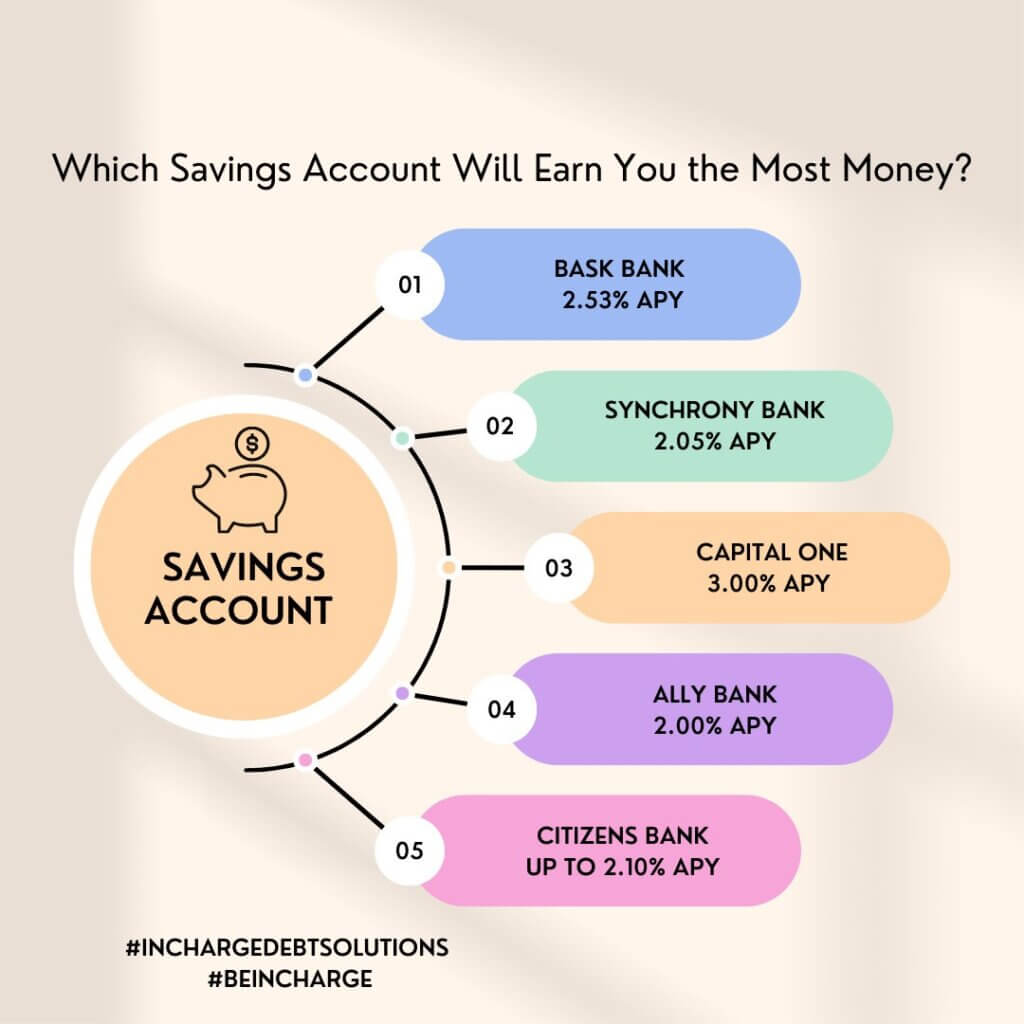

Which Savings Account Will Earn You the Most Money?

4: Automatically Set Aside Savings Each Month. An easy way to help you set aside money is by automating the transfer into your no-touch savings account. Ask your employer to adjust your paycheck so that 20 percent is automatically deposited into your emergency savings fund. If 20 percent is too high, after creating your budget, start at a place.

What’s the Best Type of Savings Account? WealthFit

Nov 21, 2023 Fact checked Certificates of deposit (CD) are deposit accounts offered by most banks and credit unions. They earn interest like savings accounts, but you're required to keep your money in the account for a set period. There are many types of CDs, and they all have one thing in common: They earn a fixed interest rate. What is a CD?

Difference between Current account and Savings account

Can You Lock A Savings Account? Understanding the Possibility Before diving into the idea of a locked savings account, it's important to familiarize ourselves with the restrictions typically imposed on traditional savings accounts. These accounts often limit the number of monthly withdrawals to encourage personal financial discipline.

The Four Types of Savings Accounts That Everyone Should Have

Make Your Savings Account Untouchable Written by David Weliver • Edited by Chris Muller • Last updated on October 13, 2023 Everyone should have a savings account. But make sure you only use it for the goals you have and not when you're strapped for cash. Here's how to make your savings account untouchable.

Best Checking Accounts of 2020 Money's Top Picks

Basic vs. Compound Interest: 7% Interest Savings Account With $5K Initial Deposit. Amount of time 7% basic interest 7% interest compounded monthly; 1 year: $5,350: $5,361.45: 2 years: $5,724.50:

What is the Best Savings Account? Blog

To open a savings account, you must submit an application. Depending on the bank or credit union, you may have the option to apply in person, by phone, via mail or online. 1. Provide details and.

FOUR INTERESTING REASONS WHY YOU NEED TO OPEN A SAVINGS ACCOUNT Online Finance Solution at a

Untouchable savings account: Is it right for you? Wanting to save, but not sure how to 'lock in' your savings if you'll just as easily spend them? We share ideas. There's a lot to love about savings accounts. They're a secure place to grow a cash stash, and with the benefit of interest earnings, you can reach savings goals sooner.

Best Savings Accounts 2021 High Yield & Online GOBankingRates

EverBank (formerly TIAA Bank), 5.15% savings APY with no minimum to open account (read full review), Member FDIC. First Foundation Bank, 5.00% savings APY with $1,000 minimum to open account (read.

Best HighInterest Savings Accounts 2023 Good Financial Cents® Savings account, High

The Bank Account Buffer™ is your very first step toward financial security and peace of mind. Learn why you need a Bank Account Buffer™ and how to create one. Here's a common question from new readers: "What's the number one most important thing I can do to improve my financial situation quickly?"

Saving Accounts Full Guide How Does it Work, Pros & Cons and How To Open an Online Account

A no-penalty CD, often referred to as a "liquid" or "breakable" CD, is a type of certificate of deposit that lets you withdraw funds before the end of your term without paying a penalty. Like.

Infographic What is a Savings Account Easy Peasy Finance for Kids and Beginners

1. Choose the Right Type of Savings Account 2. Set Your Savings Goals 3. Create Automatic Savings Deposits 4. Consider Opening Multiple Accounts 5. Follow a Budget Plan 6. Link Your Accounts to a Budgeting App 7. Consider Your Savings Untouchable

What Is A Savings Account? Definition, How They Work

The technique of buying a fixed amount of an investment at regular intervals is known as dollar-cost averaging (DCA). Lump-sum investing is when you put your amount right to work without waiting. You may be wondering: is DCA or lump-sum investing a better strategy?

What’s the Best Type of Savings Account? WealthFit

Untouchable savings accounts and CDs Grow your balance with a locked or fixed-term savings account to reduce the temptation of spending it all. By Steven Dashiell Edited by Holly Jennings Reviewed by Alexa Serrano Cruz Updated Dec 28, 2023 Fact checked Two types of accounts prevent you from accessing your money: savings accounts and CDs.